2024/25 Federal Budget

David Burnes • May 15, 2024

1. Personal income tax measures

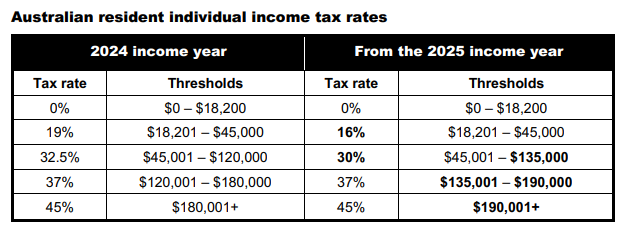

The following table outlines the marginal income tax rates and thresholds that apply for resident individuals under the revised stage three personal tax cuts from 1 July 2024

2. Small business measures

- Instant asset write-off threshold for small businesses will be increased to $20,000 for the 2025 year.

- Energy bill relief for small businesses of $325 to reduce the cost of electricity for 1 million small businesses.

3. Other measures

- The indexation rate of HECS & Trade Support Loans will be reduced effective from 1 June 2023.

By David Burnes

•

April 14, 2025

Small Businesses Affected by Cyclone Alfred: You Could Be Eligible for $25,000 in Disaster Recovery Grants

By David Burnes

•

April 14, 2025

💰 The ATO Might Owe You Money — Here’s How to Find Out Yes, you read that right. If you’ve paid your tax early , the ATO might actually owe you money in the form of Interest on Early Payments . This isn’t a scam, a loophole, or something shady. It’s legit, and it’s laid out on the ATO’s website for all to see. But most people never know to look for it. Here’s the deal: What is “Interest on Early Payments”? If you pay tax before the due date (think PAYG instalments, GST, income tax, etc.), the ATO will calculate interest on the early payment from the date you paid to the due date. So yes, paying early could earn you a small return 💸 You’re eligible if: You paid a tax bill before its due date You lodged a tax return that resulted in a debit , not a refund, and paid early How is it paid? If you're eligible, you won't receive a cheque in the mail (sorry). The interest is: Credited to your ATO account , or Can be requested , depending on how you lodged If you lodge through us, good news, we’ll keep an eye on that. But if you’ve done something early yourself, or just want to check, here's how to DIY like a boss: How to check your ATO balance & early payment credits: 🔗 Check your account balance on the ATO website 🔗 How to request a refund or credit transfer Need to make a payment? 🔗 Get your payment reference or payment slip TL; DR (Too Lazy; Didn't Read): Pay early = possible ATO interest Not automatic, but you can check it Links above will show you everything Still confused? Check the article again... it’s all there 😉

By David Burnes

•

July 1, 2024

Some of the key changes for Super Funds in the 2024-2025 financial year are:

Addresses

1/9 Rooke St

Dicky Beach, QLD 4551

Australia

Level 1, Regatta Corporate

2 Innovation Parkway

Birtinya, QLD 4575

Australia

Email Us

CPA

CPA

NTAA

NTAA

Tax Institute

Tax Institute

Xero

Xero

Class

Class

Copyright Asset Accounting QLD Ltd ©

| Disclaimer

| Site Map

| Websites for accountants by Wolters Kluwer